Legislative Update: Florida House Passes Balanced Budget, $1 Billion Tax Cut

By Space Coast Daily // February 14, 2016

LEGISLATIVE SESSION UPDATE

TALLAHASSEE, FLORIDA – The session reached its halfway point this week as the House passed our proposed budget and $1 billion tax cut.

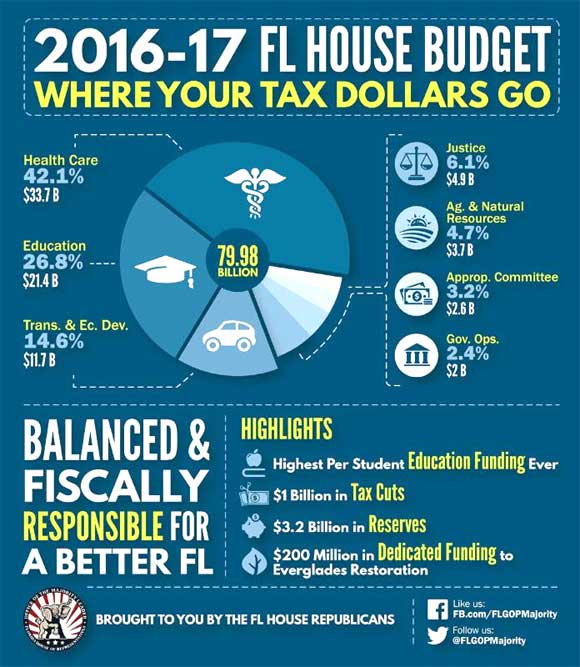

Our $79.98 billion proposed balanced budget is focused on the priorities of Florida’s families and responsibly meets the needs of our state. In this budget, we are continuing to invest in our student’s success by providing a historic level of education funding per student, exceeding the previous highest level in 2007-08 by $105 per student.

To help protect our precious natural resources, we are also including a reliable and dedicated funding source for restoring the Everglades that is expected to reach $200 million annually. In addition, the House budget places $3.2 billion in reserves for any future economic uncertainty.

Additionally, House Bill 7099 provides $1 billion in meaningful tax relief that will make Florida more affordable for our families and keep our economy growing. Some of the major components of the tax cut package include:

• A permanent cut to the business rent tax.

• A permanent elimination of the sales tax on the purchase of manufacturing equipment.

• A 10-day Back to School sales tax holiday.

• An extension of the sales tax exemption on college textbooks and course supplies.

The creation of additional 1-day sales tax holidays to encourage shopping at small businesses, purchasing new technology, and purchasing hunting and fishing equipment.

Expanded eligibility for tax relief for disabled veterans and the spouses of deceased veterans who sacrificed their lives for our country.

I am proud to support this great budget and tax cut package, which prove that when we adhere to fiscally conservative principles, we can provide for Florida’s most critical needs while still being good stewards of Floridian’s hard-earned tax dollars.

Bill to Modernize Florida Retirement System Advances

This week, the House State Affairs Committee passed House Bill 7107, which provides needed reforms to modernize the Florida Retirement System (FRS).

Effective July 1, 2016, the bill changes the default from the Pension Plan to the Investment Plan for enrollees who do not select either plan during the election period.

In addition, effective July 1, 2016, the bill allows renewed membership in the Investment Plan for a retiree of the Investment Plan or an optional retirement program if they return to employment with an FRS employer.

Finally, the bill provides new survivor benefits to spouses and children of Investment Plan members who are killed in the line of duty.

The new survivor benefits are the same as those provided for members of the Pension Plan and will be provided retroactively to the survivors of all Investment Plan members who have been killed in the line of duty since 2002.

In my opinion, this bill provides reasonable changes to the FRS, which will be beneficial to both current enrollees and Florida’s taxpayers. I believe these reforms will not only reduce risks to taxpayers, but will also provide portability and flexibility in retirement to a more mobile workforce.

CLICK HERE FOR MORE LOCAL NEWS