YOUR OPINION: Trump Making America Rich Again, Something Naysayers Said Would Never Happen

By Scott Olson // February 20, 2018

Trump's economic policies helping all Americans

Remember the political pollsters told us “uniformed” Trump supporters (“deplorables” as Hillary Clinton called us) that Donald Trump couldn’t win – as if it was a fact. Liberals, the far-left liberal Clinton News Network (CNN), MSNBC and other cable news shows said Clinton had the election in the bag.

It appeared that big companies put all their support behind Clinton. They did not want Trump for President as big companies like the status quo. They want to be able to bribe politicians – they call it “lobbying,” but it is still bribery.

They were afraid that Trump, with his billions, couldn’t be bribed. Look at the net-worth of Democrats and Republicans in office. These career politicians typically went into office with little personal net worth and now many, like former President Barack Obama, Nancy Pelosi and the Clintons are now very wealthy.

History and the economy now show that media elite and career politicians were wrong about Trump and the economy. As usual, politicians and the media know nothing about money and stock markets.

President Trump was elected by the people. We were tired of criminals running our once great country. We were ready for a successful businessman instead of the same old politicians like Clinton and Sanders manipulating uneducated, low-information voters into giving away more of our tax dollars to those who padded the campaign chests of liberals.

We wanted change and this time we got it – real, positive change. Obama raided the treasury claiming it was for “shovel ready jobs,” and then laughed saying, “I guess they weren’t quite shovel ready.”

Obama also said if you like your doctor, you can keep your doctor and every American family will save $2,500 annually on his ObamaCare (Wall Street Journal “the Un-Affordable Care Act”), while in reality health premiums more than doubled for many of us, leaving less to invest and grow our economy.

ObamaCare was the most expensive entitlement, or giveaway, or tax in history. His programs didn’t help the masses but favored his preferred groups.

President Trump is bringing jobs back to the United States as well as creating more jobs. With unemployment at the lowest in history, while our GDP growth is the highest, we don’t have enough qualified employees to fill the jobs being created by Trump.

Repatriating trillions of dollars and reducing the corporate tax-rates from the highest on Earth will help create more jobs. More jobs create more profits and higher stock prices. We all make money.

Just one example of Trump’s economic policies helping all Americans is Tim Cook, Apple CEO, Praising Trumps Tax-reform. Apple is repatriating as much as $350 billion and creating 200,000 new jobs in the U.S.

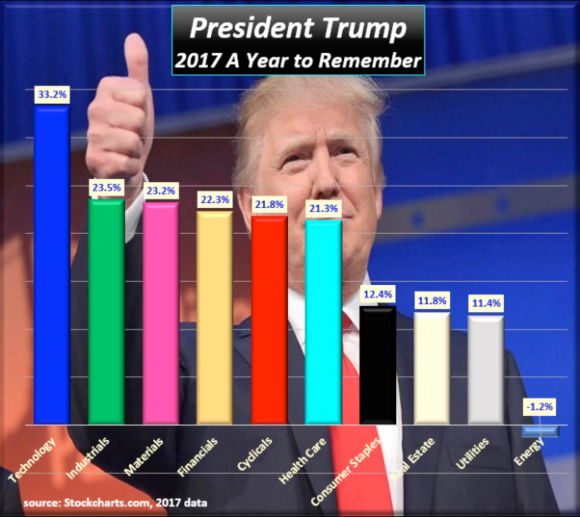

Which sectors did best?

Bitcoin, covered in our last article, isn’t a sector but just one of the thousands of Cryptocurrencies which are among the highest risk investments on Earth.

For whatever its worth, everyone I talk with agrees that bitcoin is worthless “air,” but greed has set in similar to the Dot.com era, with the stock market crash of 2000. As of January 17, Bitcoin plunged further into the abyss at $9,511, down 50 percent from almost 20,000 a few weeks ago.

What’s Hot? Tech, tech, more tech was the leading sector of the S&P 500. Stocks, mutual funds and funds in variable annuities that made the most profits were technology. And China, India, or emerging markets posted gains in excess of 50 percent.

Don’t take this as advice to put all your investments into Tech stocks. Markets change. Since about mid-year, even though tech stocks/funds have continuing momentum, oil and energy stocks came from the back of the pack to beat every other major sector.

Many experts believe oil will dominate in 2018. Will Oil and Energy Dominate in 2018?

Stock prices are skyrocketing too fast and way ahead of earnings. While most global equity markets have had one of their best years performance in decades, it’s not different this time.

All major markets are way out of whack, over-bought, over-priced, with unsustainable valuations. Why have all markets skyrocketed with Trump? Because the majority believes in President Trump, and for good reason. He is doing what we elected him to do, however, even he can’t reduce market risk.

Price to Earnings is a fundamental technical indicator and popular way to value stocks, funds and the markets. However, PE levels are at twice their averages. In fact, PE ratio of the S&P 500 is higher today than at the Crash of 1929.

The Shiller S&P 500 PE is at 33.68 compared to its average of 16.15. The Shiller PE has only been this high twice since 1881. One of these was the day before the crash of 1929. The other was leading into the crash of 2000.

The hope is that President Trump will continue doing so well for our economy that corporate earnings will catch up to the sky-high stock prices, but this is highly unlikely. While our equity markets could continue higher for a while, many experts predict another crash like in 2000 and in 2007.

In a nutshell, most financial people we work with believe the markets have more upside potential, but without exception, they all believe, because of fundamentals, we need a major correction soon, if not a crash like in 1929, 1987, 1991, 2000, and 2007.

Please feel free to call or email if you have questions about anything financial you would like to share. If you have questions, I can guarantee other investors, retirees, and soon-to-be retirees do too.

For more information or FREE portfolio RISK ANALYSIS, contact Scott L. Olson, President, Atlantic Financial Advisors, LLC, Fiduciary & Registered Investment Advisor at 321-751-5599 or email Scott@AtlanticFinancialAdvisors.com. Atlantic Financial Advisors is located at 3682 North Wickham Rd, Suite C, in Melbourne, Florida.

ABOUT THE AUTHOR

With 38 years experience in Financial and Estate-Planning, Wealth Preservation and Wealth Transfer, Scott Olson provides required Continuing Education courses to Attorneys, and CPAs in Florida.

His expertise includes the “Substantially Discounted Roth-Conversion” and the Annuity Arbitrage, tax-favored income and estate-tax reduction wealth transfer techniques. He presented the “Substantially Discounted Roth-Conversion” at the Florida Bar Tax-Section, October 2014 conference, and their 1-hour CLE teleconference in March 2015.

All investing is subject to risk, including possible loss of principal. Advisory Services through Atlantic Financial Advisors, LLC (AFA), Registered Investment Advisor. Securities and additional Advisory services offered through Independent Financial Group, LLC (IFG). Member FINRA/SIPC Ÿ AFA and IFG are not affiliated. OSJ Branch: 12671 High Bluff Dr, Ste 200, San Diego, CA 92130.

CLICK HERE FOR BREVARD COUNTY NEWS