Florida Ranks #5 for Best Business Tax Climate States

By Space Coast Daily // October 10, 2013

Gov. Scott Touts State's High Ranking

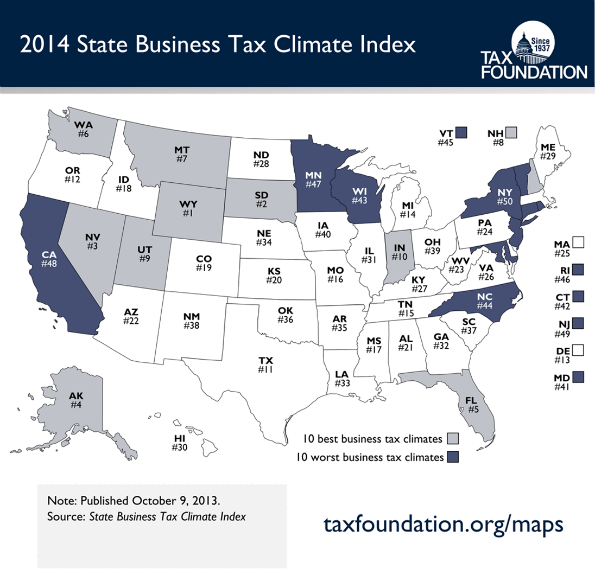

BREVARD COUNTY, FLORIDA — According to an index published by the Tax Foundation, Florida ranks #5 overall out of the 50 states. (Click HERE to see the full report on PDF)

The Tax Foundation’s 2014 edition of the State Business Tax Climate Index enables business leaders, government policymakers, and taxpayers to gauge how their states’ tax systems compare.

The 10 best states in this year’s Index are:

- Wyoming

- South Dakota

- Nevada

- Alaska

- Florida

- Washington

- Montana

- New Hampshire

- Utah

- Indiana

Below is an excerpt from Taxfoundation.org’s explanation of the gauge.

“The absence of a major tax is a dominant factor in vaulting many of these ten states to the top of the rankings. Property taxes and unemployment insurance taxes are levied in every state, but there are several states that do without one or more of the major taxes: the corporate tax, the individual income tax, or the sales tax. Wyoming, Nevada, and South Dakota have no corporate or individual income tax; Alaska has no individual income or state-level sales tax; Florida has no individual income tax; and New Hampshire and Montana have no sales tax.”

The Tax Foundation is a non-partisan tax research group based in Washington, D.C.