3 Painful Investing Mistakes You Must Avoid

By Space Coast Daily // June 30, 2022

With stock markets down over 21% since the start of the year, and bonds, unusually, also down, investors have been scratching their heads trying to figure out a strategy for this period of turbulence. When volatility defines a market, and everyone seems to be losing, it’s easy for investors to make mistakes that compound difficult conditions. Here are 3 of the biggest mistakes that investors often make.

1. Cashing Out

Nobody would ever tell you to remove your money from the bank, and yet, many people often advise that investors should cash out from the market. Investors should think of asset markets as banks, and realize that the only way to truly protect your wealth is by staying invested. If you’re afraid that because there’s a bear market, you will lose money, so you think it’s better to hold cash, well, guess what, inflation will eat a large chunk of that money.

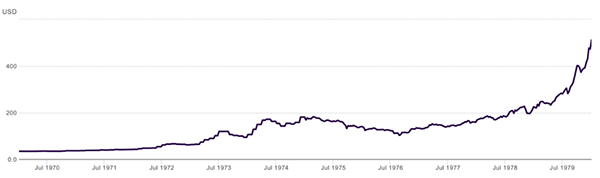

Cash does not offer protection during periods of stagflation, which are charecterized by stagnant economic activity and high inflation. Inflation means, by definition, that cash is buying less and less, it’s falling in value. The question is not, “Should I cash out”, the question is, “What assets should I be invested in”. In stagflationary periods, you want to be invested in real assets, particularly gold, which finished the 1970s, the last time we had stagflation, with a 1,355% decade gain.

2. Not Using Individual Retirement Accounts

If you’re eligible for an individual retirement account (IRA), not using one is a huge dereliction of duty. High net worth individuals hold 55% of their overall wealth in IRAs. What makes IRAs special is that they are tax-free or tax-deferred. Not having to pay taxes is like getting a loan from the government which you only have to repay when you get money out of your IRA. In the interim, you can use that loan to build wealth.

Going with our real assets theme, you want to invest in a self-directed IRA, which will allow you to invest in alternative investments such as real estate, mortgages, franchises, partnerships, precious metals such as gold, silver platinum, and palladium. If you want to invest in gold, you can then consult the best gold IRA company you can find and create a gold IRA account.

3. Not Investing in Index Funds

Index funds will beat most active funds most of the time.They are essential to any portfolio. You want a portfolio diversified across assets, and that means having real assets such as gold, along with stocks and bonds, in your portfolio. That’s important for diversification so that if one goes down, one of the others will preserve your wealth.

Index funds are the best way to invest in stock markets. Regardless of what you hear, research has found that most stocks do not outperform Treasury bills. The “market” return comes from a few stocks that make up for losses virtually everywhere. Index funds allow you to invest in the universe of stocks, freeing you from having to pick those few winners in the market.