Breakdown of Average Savings by Age

By Space Coast Daily // November 15, 2022

Savings refers to funds saved aside for anticipated purchases or, in the case of an emergency fund, unanticipated costs.

Given that each person’s financial condition is unique, determining the average savings by age is not an exact science.

Saving money may be simpler for someone with a higher income and lesser expenses than for someone with a lower income or who has a large debt to pay off.

General Information

The Federal Reserve divides American savings into “transaction accounts” and “time deposit accounts” to maintain track of total savings in the country.

Account holders with transaction accounts may quickly make deposits and withdrawals. Transaction accounts include, for instance:

■ savings accounts

■ escrow accounts

■ accounting for money markets

Time deposits are distinct since, after an account is formed, they normally don’t permit the movement of money in and out of the account.

Often, for various purposes, you have to take payday loans online same day deposit because sometimes there is no other way out. A certificate of deposit (CD) is the greatest illustration of a time deposit account since you risk steep penalties if you take your money out too soon.

The average transaction account balance in 2019 was $41,600, according to the Fed’s most recent Survey of Consumer Finances. The median total amount of checking and savings was $5,300.

What You Ought to Have Saved at Each Age

While knowing the average amount individuals have saved by age is helpful, that number may not accurately reflect the amount experts believe you should have saved by each age.

Priorities first There is no universally applicable number. It’s critical that your savings – and savings goals – align with your way of life.

This covers your salary, your shopping preferences, where you live, whether you have a car, if you have children, if you’re using universal life insurance for retirement, whether you pay rent or a mortgage, and more.

Based on their budget, each person has their magic number. In addition, the Bureau of Economic Analysis reports that the Personal Savings Rate is currently hovering around 3%

By setting particular savings objectives, you may determine your magic number. For instance, you intend to finish your home fitness regimen within the next six months and plan to save money for a $1,000 treadmill.

You’ll have a better idea of how much you’ll need and how long it could take you to get there if you’re clear about your goals and when you plan to achieve them.

The secret to saving for both short-term and long-term objectives is to avoid setting aside substantial sums of money all at once.

Finding an amount to save each month that works for you is the key, followed by consistency

You may consider your savings as a percentage of your income as well. According to a common budgeting plan known as the 50/30/20 budget, you should allocate 20% of your income to savings and debt reduction and 50% of your income to necessities, and 30% to wants.

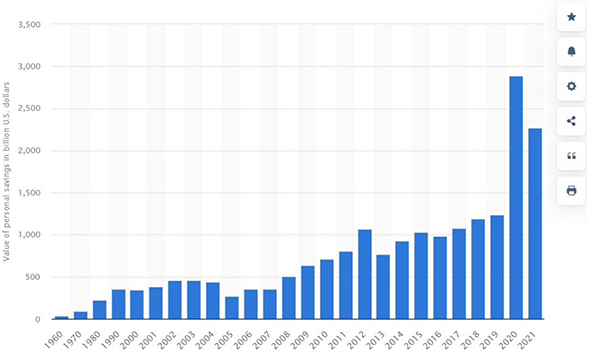

It is gratifying that, according to Statista, the value of personal savings of Americans in 2022 increased extremely strongly, if you do not count 2021.

Value of personal savings in the United States from 1960 to 2021

Average Savings for People Under 35

It’s difficult to determine the average for each age group because this ranges from kids who have just from high school to recent college graduates to young professionals who have worked for a decade or more.

Three to six months’ worth of costs should ideally be kept aside in an emergency fund. It’s advised to try to have $1,000 available in a savings account as a minimum for unforeseen costs.

Contributing as little as the amount the employer would match is an excellent method to safeguard possible future savings because compound interest works in your favor.

For comparison, in 2019 someone between the ages of 20 and 29 had an average 401(k) savings of $10,500.

Savings by Age 40 on Average

Federal Reserve data for adults aged 35 to 44 depict Americans at this period of life.

According to the most current data from the Fed, those over 40 had an average savings of $27,900. The average amount saved is $4,710.

You’re most likely in your prime earning years by the time you’re in your 40s, and you may have more money to put away.

Your objectives might change at this point. Increasing your emergency fund may not be as crucial as saving for retirement.

Savings at Age 50

Maintain your retirement savings growth and look at long-term care insurance. Think over your present course and take action to make sure you’re on the path you anticipated because this following chapter could be weighing more heavily on your thoughts.

Use an online retirement calculator and keep in touch with your financial advisor, particularly in light of the present financial crisis.

Your non-retirement financial needs may decrease as you approach retirement in your 50s and 60s.

Your mortgage and automobiles may be paid off, your children may be grown and living elsewhere, and your salary should increase over time.

Some big bills and life objectives will be added to and removed from the list depending on your age, among other factors.

For instance, paying off student debts may be particularly taxing for young individuals, but once they are done, there may be savings opportunities.

Savings at 55-64

In 2019, respondents aged 55 to 64 had the second-highest average balance in their transaction accounts, at $57,670.

In 1998 and 2010, the 55-64 age group’s account balances passed those of the 65-74 age group, which had been keeping up with it closely.

As responders aged 55 to 64’s retirement ages drew nearer, it’s possible that this increased saving was the cause of these periodic surges.

Conclusion

Of course, people (at least those with little to no ancestral wealth) will start with little in the way of savings at the beginning of their professional paths, especially those with low-paying entry-level positions.

An individual should be earning more as they age and advance in their careers, allowing their savings to increase and, ideally, reach their peak as retirement approaches.

Savings will start to decline after retirement as people start to spend more than their retirement income.