WATCH: Corporate Site Selection Expert John Boyd Details Palm Bay Being Named Top Destination for Post-Pandemic Corporate HQ Offices

By Space Coast Daily // March 20, 2023

SPACE COAST DAILY TV SPECIAL PRESENTATION

WATCH: John Boyd, the principal of The Boyd Company Inc., stopped by the Space Coast Daily TV Studios to provide expert commentary about Palm Bay being named one of the Best U.S. Cities for Post-Pandemic Corporate HQ Offices.

BREVARD COUNTY, FLORIDA – John Boyd, the principal of The Boyd Company Inc., stopped by the Space Coast Daily TV Studios to provide expert commentary about Palm Bay being named one of the Best U.S. Cities for Post-Pandemic Corporate HQ Offices.

According to the new 2023 national site selection study that names the top U.S. cities for the post-pandemic corporate headquarters office, the “new normal” is remote working trends. The study also examines state tax structures, operating costs, and growing fiscal and quality of life challenges in historic hubs of head office concentration like New York, Philadelphia, Chicago and San Francisco.

The report’s cost analysis covers all major geographically-variable cost factors critical to the corporate site selection process, including labor, real estate, construction, utilities, taxes and travel.

The report was conducted by The Boyd Company, Inc., corporate location consultants.

Post-Pandemic Relocation Trends

As companies reduce their total office square footage, exchange private desks for collaboration areas and add amenities aimed at encouraging workers out of their homes and back into their offices, they are increasingly changing the look of the post-pandemic office and where it should be located.

This rethinking of the physical office is being carried out under a strategic cost-containment mode, given the economic challenges of 2023 and the talk of a potential recession. Most companies have already embraced some form of the hybrid office and are concluding that it makes no sense to pay for office space filled with empty desks and few workers.

Nationally, the days of one large, downtown corporate headquarters office is fast disappearing. Today, many companies are transitioning to a hub-and-spoke model with one downsized central head office hub and additional smaller spokes—or satellite offices for administrative support.

Millions of office employees are still working from home because of the pandemic and will continue to do so long into the future. Only about half of office workers in New York’s Manhattan – the nation’s largest office market – are back in the office on any given day.

The option to work remotely is also being used as a compelling HR recruiting tool in this era of severe worker shortages and the impact of the so-called “great resignation.”

With a reduced head office staff and with other satellite offices performing many of the administrative functions historically carried out at the headquarters site, companies will be increasingly relocating to attractive, smaller market suburban locations offering lower operating costs, superior state business climates, and growth-oriented demographics to housing their new downsized corporate headquarters office saving millions in annual operating costs and taxes and placing them is a highly favorable recruiting position.

The ‘Urban Doom Loop’

Academics are already studying how remote working and the post-pandemic, downsized corporate head office will be impacting the fiscal health and quality of life of big cities like New York, Chicago, and San Francisco – historically housing a large percentage of our nation’s major corporate headquarters.

Columbia Business School finance professor Stijn Van Nieuwerburgh warns of an “urban doom loop” caused by the sudden shift to work from elsewhere brought on by the pandemic.

The “doom” Van Nieuwerburgh refers to is the loss of tax revenues and fees to local governments, declining revenues for public transportation, and losses associated with having fewer high-income people and firms in urban centers.

This urban doom loop could result in municipal fiscal crises not unlike what New York City experienced in the 1970s and Detroit in 2013.

Already, San Francisco is facing a projected $728 million deficit over the next two fiscal years as the city confronts falling tax revenue and the loss of such high-profile corporate headquarters as Charles Schwab, McKesson, Oracle, Tesla, HP, not to mention significant downsizing at Twitter’s corporate headquarters and a likelihood of its eventual move to northern Nevada or Texas.

The upshot of this exodus of companies and the decline in people coming to the office is cutting heavily into municipal property tax revenues that will necessitate spending cuts in the very things that make big cities like New York, San Francisco, and Chicago so appealing such as public transit, entertainment, shopping, restaurants, and cultural amenities.

Other challenges like spiking crime, homelessness, and New York City’s controversial congestion pricing – making it more expensive to commute into the city – are not addressed by the Columbia professor but are additional drivers behind the head office exodus from our nation’s urban centers.

Suburban Sites in Small Market Cities Are Alive and Well

The suburban office market continues to be very much alive and well throughout most of the country.

From Boyd’s national site selection work and dealings with HR department heads, recruiters, and relocation managers, the popular notion that most young professionals want to live in downtown urban enclaves is often overstated.

This has been the case for some time, only to be heightened by the pandemic, remote working, soaring big city housing and rent costs, and growing concerns about crime and safety in many urban centers.

While millennial and Generation Z recruits are not necessarily interested in golf courses and gated communities, they do like open spaces, jogging trails, and parks, along with more affordable and satisfying housing options.

Corporate HQ Relocation Drivers Favor States Like Nevada, Florida, Texas

The question then becomes, where should these post-pandemic, downsized corporate headquarters be located? Major drivers behind the selection of these new headquarters locations include:

■ States with superior corporate income tax climates for companies;

■ States with superior personal income tax climates for C-suite executives and staff

■ Locations with attractive lifestyle amenities;

■ Locations with favorable operating cost structures;

■ Locations with strong travel & hospitality support services for periodic corporate-wide staff meetings, team building sessions, employee training & enrichment engagements as well as client-servicing functions;

■ Locations showing positive in-migration demographics and business attraction trends; and

■ Locations with attractive housing markets for C-suite executives.

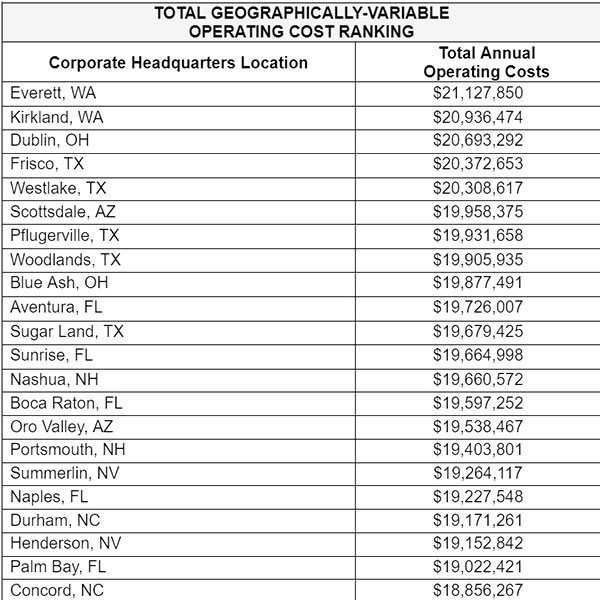

Total Annual Operating Cost Ranking

Shown below is an annual cost ranking of the top post-pandemic corporate headquarters locations named in the Boyd report based on the construction of a new Class-A, 75,000 sq. ft. corporate head office employing 200 administrative support workers.

Operating Costs Under the Microscope

Historic levels of inflation, new corporate tax hikes, and recessionary headwinds are all causing a greater focus on comparative operating cost structures in corporate relocation decisions, including the headquarters office.

Many site-seeking companies are concluding that improving the bottom line on the cost side of the ledger will be far easier than on the revenue side in 2023.

Cost differentials between an acceptable post-pandemic headquarters site and an optimum location can be substantial even within a given region.

Itemized annual operating costs for Palm Bay and other low and high-cost head office cities included in the new Boyd Report are shown below.

Top Corporate Headquarters Location in the West: Minden, Nevada

Future corporate headquarters site with a stunning Sierra Nevada view in Minden, Nevada, a state with neither a corporate nor personal income tax. Minden – a growing submarket in the Reno/Tahoe metro area – is ranked the top location in the West for the new normal, post-pandemic corporate headquarters office.

Minden – located within minutes of Lake Tahoe and its attractions – is a popular landing spot for fleeing Bay Area and Northern California companies and residents.

Top Corporate Headquarters Location in the East: Ponte Vedra, Florida

Ponte Vedra is located 24 miles east of Jacksonville in Northeast Florida’s First Coast Region.

The area is home to major operations of Deutsche Bank, CIT, Florida Blue, Bank of America, The Mayo Clinic, CSX, PGA TOUR, and others.

Ponte Vedra is within 30 minutes of both the Jacksonville International Airport – one of the fastest-growing midsized airports in the U.S. – and the Northeast Florida Regional Airport in nearby St. Augustine.

The Boyd Company Inc., is a leading, internationally-recognized consultancy in the dynamic arena of corporate site selection. Boyd’s five decades of expert counsel to corporate decision-makers, the investment and economic development communities, and policymakers put it at the epicenter of the corporate mobility industry.

Each of Boyd’s service channels are devoted to providing accurate and timely information to ensure that growing companies find the optimal location for their new facilities.

All of this gives Boyd unparalleled knowledge, influence, and reach within the trillion-dollar business location marketplace.

Founded in 1975 in Princeton, NJ, Boyd corporate clients encompass a wide range of office, manufacturing, supply chain, and service industries. Clients include Boeing; PepsiCo; Visa International; Hewlett-Packard; JP Morgan Chase; UPS; Royal Caribbean Cruises; Dell; TD Canada Trust, to name a few.

CLICK HERE FOR BREVARD COUNTY NEWS