Florida Deal Shows SPAC Growth Potential

By Space Coast Daily // June 29, 2021

A few years ago Special Purpose Acquisition Companies (SPACs) were at the margins of the investment world, discredited for their dubious ability to benefit investors compared to the profit often made by sponsors.

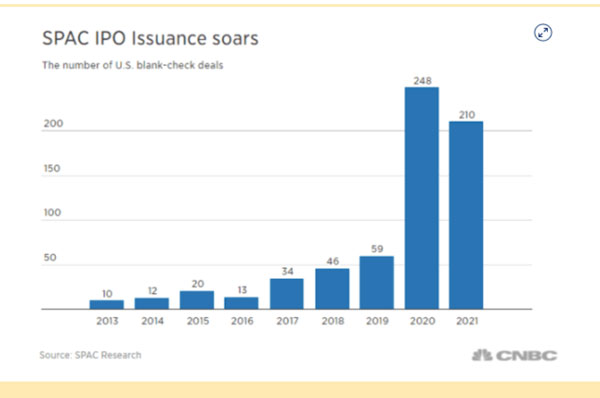

But from 2019 a change began to take place, which is affecting the entire IPO market and penetrating the business world right down to our Florida medical care providers. Those considering whether to nvest in SPACs should note local as well as national trends.

SPACs offer an alternative way for private companies to become listed on the stock exchange. They are sometimes called “blank check” companies, because they are companies formed with no operations of their own. Investors buy shares in the SPAC, whose sponsors pledge to find and merge with a target company within two years.

The target company becomes public via its merger with the SPAC, thereby avoiding the opaque and lengthy traditional IPO (Initial Public Offering) route. Those who buy shares in the SPAC stand to benefit from a potential rise in value of the SPAC if it finds an appropriate target business, one that can use the cash injection that the SPAC merger brings to generate or foster growth.

The latest SPAC announcement in Florida sees CareMax Medical Group LLC and IMC Medical Group Holdings LLC merge with SPAC Deerfield Healthcare Technology Acquisitions Corp. in a deal worth $614 million in cash and stock.

The Deerfield SPAC formed in July 2020 by offering 12, 500,00 units of stock at $10 per unit. In the end it sold 14,375,000 to raise over $140 million. It is sponsored by an affiliate of Deerfield Management Company, L.P. and Richard Barasch, a veteran healthcare public company executive and investor.

In December 2020 it announced its intention to merge with CareMax and IMC and in March 2021 Deerfield filed its preliminary proxy on the proposed business combination.

As with all SPACs, the shareholders have the right to vote on whether to go ahead with the proposed merger or not, and a date for this vote has not yet been announced. Shareholders will need to assess the value of the two target companies.

IMC, which won a Humanitarian Organization of the Year Award for its charitable efforts during the COVID-19 pandemic, runs 13 medical centers, 11 activity centers and 11 access centers for families in Florida.

It offers telephone access to health professionals, complementary transportation to and from appointments and a prescription delivery service, as well as a wide range of preventative and responsive services such as cardiology, gastroenterology, x-rays and ultrasounds.

With a particular emphasis on ensuring access for the Hispanic population and on supporting the most vulnerable members of the community, IMC promotes holistic view on supporting wellness among its members. The total consideration in the deal for IMC Health equity holders will be $250 million, net of debt.

CareMax is set to receive $364 million, and will keeps its name to describe the new merged company. Caremax operates 26 medical centers in south and central Florida serving 16,000 Medicare Advantage members and 36,000 Managed Medicaid and Affordable Care Act patients.

The acquisition includes CareMax’s proprietary “CareOptimize” technology platform that is in use at all of its centers, which supports physicians with efficient medical utilization, enhanced risk management, pharmacy management and specialist network development.

Since announcing the deal, Deerfield’s NASDAQ stock has risen from around $11.20 to $14.95 as of April 20, 2021. The rise reflects investor confidence that the prospective merger can add value to these Florida medical services providers. And the logistics of the deal are yet another example of the SPAC dominance over IPOs in recent months.

To understand the phenomenon, consider that in 2019, 59 SPAC deals raised $13.5bn and in 2020, 237 SPACs raised $80bn. Now realize that by April, 308 SPACs had already been formed in 2021, with a value of $324 million. SPAC sponsors are increasingly high profile, experienced venture capitalists, or even celebrities. They place their reputations on the line when they raise money towards an unknown future deal. However, despite the uncertainty, SPACs are overtaking IPOs as the way for dynamic private businesses to become publicly-traded.

So how can investors gain exposure to these developments? One option is to research and buy stock in a newly formed or existing SPAC. The risk here, as with any venture capital, is that there is no guarantee that this particular SPAC and its target company will see great success. Another option is to go for a SPAC ETF, which may offers exposure to the whole SPAC universe while mitigating some of the risk of any one individual deal. As SPAC deals grow in popularity and may snap up some of the most exciting and fast-moving companies of tomorrow, a SPAC ETF can provide balanced exposure to potential gains from these deals.

Important Disclosures:

The Fund’s investment objectives, risks, charges, and expenses must be considered carefully before investing. The prospectus contain this and other important information about the investment company. Please read carefully before investing. A hard copy of the prospectuses can be requested by calling 833.333.9383.

Defiance Next Gen SPAC Derived ETF:

Investing involves risk. Principal loss is possible. As an ETF, SPAK (the “Fund) may trade at a premium or discount to NAV. Shares of any ETF are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

The Fund is not actively managed and would not sell a security due to current or projected under performance unless that security is removed from the Index or is required upon a reconstitution of the Index.

A portfolio concentrated in a single industry or country, may be subject to a higher degree of risk. The Fund is considered to be non-diversified, so it may invest more of its assets in the securities of a single issuer or a smaller number of issuers. Small and mid-cap companies are subject to greater and more unpredictable price changes than securities of large-cap companies.

The SPAK Fund invests in companies that have recently completed an IPO or are derived from a SPAC. These companies may be unseasoned and lack a trading history, a track record of reporting to investors, and widely available research coverage. IPOs are thus often subject to extreme price volatility and speculative trading.

These stocks may have above-average price appreciation in connection with the IPO prior to inclusion in the Index. The price of stocks included in the Index may not continue to appreciate and the performance of these stocks may not replicate the performance exhibited in the past.

In addition, IPOs may share similar illiquidity risks of private equity and venture capital. The free float shares held by the public in an IPO are typically a small percentage of the market capitalization.

The ownership of many IPOs often includes large holdings by venture capital and private equity investors who seek to sell their shares in the public market in the months following an IPO when shares restricted by lock-up are released, causing greater volatility and possible downward pressure during the time that locked-up shares are released.

Some SPACs may pursue acquisitions only within certain industries or regions, which may increase the volatility of their prices.

Public stockholders of SPACs may not be afforded a meaningful opportunity to vote on a proposed initial business combination because certain stockholders, including stockholders affiliated with the management of the SPAC, may have sufficient voting power, and a financial incentive, to approve such a transaction without support from public stockholders.

As a result, a SPAC may complete a business combination even though a majority of its public stockholders do not support such a combination.

Because SPACs have no operating history or ongoing business other than seeking acquisitions, the value of the securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable acquisition.

There is no guarantee that the SPACs will complete an acquisition or that any acquisitions that are completed will be profitable. Unless and until an acquisition is completed, a SPAC generally invests its assets in U.S. government securities, money market securities, and cash.

SPAK is new with a limited operating history.

Read more about SPAK here, including performance and holdings: https://www.defianceetfs.com/spak/. Fund holdings are subject to change and should not be considered recommendations to buy or sell any security. As of June 27, 2021, CareMax Medical Group LLC is held in the Fund; , IMC Medical Group Holdings, and Deerfield Healthcare Technology Acquisitions Corp. are not currently held in the Fund.

Opinions expressed are subject to change at any time, are not guaranteed, and should not be considered investment advice.

Defiance ETFs are distributed by Foreside Fund Services, LLC.