BUSINESS INSIDER: How Your Tax Bracket Could Change In 2018 With New GOP Tax Reform Bill

By Elena Holodny, Business Insider // December 18, 2017

ABOVE VIDEO: Bad Spending Habits Rich People Avoid. (Business Insider Video)

(BUSINESS INSIDER) – Republican leaders appear to have enough votes needed to pass their final tax bill.

The bill, the Tax Cuts and Jobs Act, was finalized this week by a conference committee made up mostly of members of the House and Senate committees that wrote the versions that those chambers passed.

Republican leaders have said they plan to hold a vote on the compromise bill early next week, with a goal of President Donald Trump signing it by Wednesday.

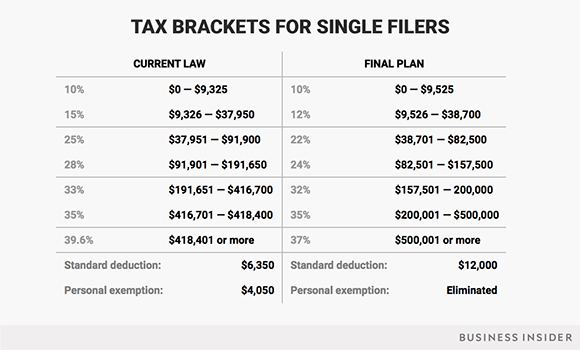

Here’s how this new tax plan could change federal income tax brackets in 2018 compared with those in 2017.

CLICK HERE TO READ FULL ARTICLE ON BUSINESS INSIDER

- 10%: $0 to $9,525 of taxable income for an individual

- 12%: $9,526 to $38,700 individual

- 22%: $38,701 to $82,500 individual

- 24%: $82,501 to $157,500 individual

- 32%: $157,501 to $200,000 individual

- 35%: $200,001 to $500,000 individual

- 37%: over $500,000 individual